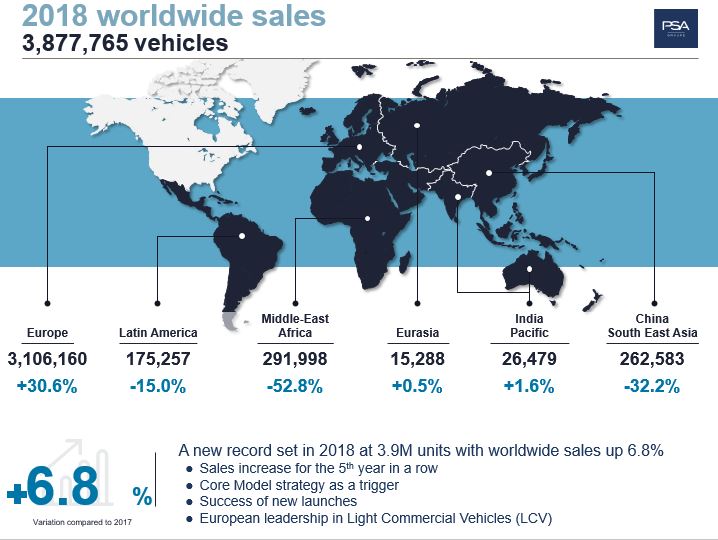

A new record set in 2018 at 3.9M units with worldwide sales up 6.8%

- Sales increase for the 5th year in a row with improved pricing power, in a context of economic and geopolitical headwinds

- Core Model strategy as a trigger: success of new launches and European leadership in Light Commercial Vehicles

This profitable growth, reaching circa 3.878.000 units, has been leveraged by Groupe PSAproduct offensive in motion with more than 70 regional launches in 2 years, customer driven Core Model Strategy deployment and commercial network commitment.

- Groupe PSA products have been on all short final lists of prestigious automotive contests every year since 2014 and have been awarded this year “Van of the Year IVOTY 2019” (Peugeot Partner, Citroën Berlingo Van, Opel/Vauxhall Combo) and ‘Best Buy Car of Europe 2019’ AUTOBEST (Citroën Berlingo Van, Opel/Vauxhall Combo Life and Peugeot Rifter), following Citroën C3 Aircross last year.

- Groupe PSA Core technology has also been awarded with the International Engine of the Year prize for the 4th year in a row for its Turbo three-cylinder petrol engine (110 and 130 hp).

- Groupe PSA SUV models are particularly successful, driven by the Peugeot 2008, 3008[1], 5008 (leader in Europe), Citroën C3 Aircross[2], C3-XR, C5 Aircross, DS 7 Crossback, Opel/Vauxhall Crossland X, Mokka X, and Grandland X. The momentum will continue in 2019 with major launches for all brands.

- The Group announced its electrification offensive for all brands, with first PHEV[3] and EV[4] models available for customers in 2019, starting with the DS brand.

Groupe PSA achieves new record LCV sales: 564 147 vehicles sold, + 18.3%.

- Groupe PSA renewed its range of compact vans in 2016 and of B-LCV in 2018 and has consolidated its leading position in Europe in every sub-segments, grasping almost 1 out of 4 LCV customers.

- The Group’s LCV offensive has set the basis for overseas growth with the successful launch of production of Peugeot Expert and Citroën Jumpy in Eurasia and the very promising start of our comprehensive range of LCV products and services for Latin American clients.

Europe[5]: Change of scale with 17.1% market share.

Groupe PSA took full advantage of its perfectly managed new WLTP standard implementation phase to gain a competitive edge in the last four months of the year. Group market share reaches 17.1% by end 2018, up +3.8 pt, underpinned by Peugeot and Citroën brands that are the best progressing brands in 2018, with almost +5% sales increase for both brands among the top 10 brands in Europe.

Peugeot stands out for its success: SUV European leader, number 1 in Spain, number 1 in France on B2C and B2B passenger cars. Citroën reaches its best level of sales in 7 years.

DS Automobiles marks a breakthrough with 6.7% of sales increase, supported by

DS7 Crossback launch. Opel/Vauxhall is continuing its product offensive driven by the X family.

Groupe PSA exceeds market performance and is improving in all main markets: France (+2.6 pt), Spain (+4.2 pt), Italy (+3.9 pt), Great Britain (+4.8 pt), Germany (+3.7 pt).

Middle East – Africa: the Group remains offensive in a chaotic regional context.

Despite strong headwinds mainly due to wind down in Iran[6] and Turkish market downturn, Groupe PSA market share increased in Morocco (+1.7pt), Tunisia (+1pt) and Egypt (+3.1pt) and the Group remains market leader in French Overseas Departments.

The regional industrial footprint is under deployment to become operational in 2019 with the start of production of Kenitra plant in Morocco, as a key milestone.

China & South East Asia: Groupe PSA works to overcome China situation and prepares its commercial offensive in South East Asia.

In a declining Chinese passenger vehicle market (-2%), sales are down 34.2%. The Group is working on action plans with its partners to tackle current issues. The Group is implementing its electrification strategy with the Fukang brand, followed by PCD[7] electrified models from 2019 onwards. Moreover the core model strategy is under execution to propose a product offering designed for Chinese clients.

Sales in South East Asia doubled versus 2017, amounting to 10,882 vehicles. The joint venture with Naza Corporation Holdings (Malaysia) will start delivering its first productions in 2019 with the Peugeot 3008 and 5008.

Latin America: the drop in sales is largely linked to the strong decline of the Argentinian market (-32% in H2) related to the country’s economic context, with a significant exchange rate impact and a difficult Brazilian market, while sales remain well oriented in the Pan-American zone (54,887 units, +13,3%) – composed mainly by Chile, Mexico, Colombia, Peru, Uruguay and Ecuador.

The launch of the new C4 Cactus SUV industrialized in the region, is encouraging. The local manufacturing of the LCV range is in process (launch of the Jumpy MiniBus version, Berlingo, Boxer and Jumper in Brazil, Jumpy and Expert Crewcab in Argentina and the electric Partner in Chile and Uruguay).

India-Pacific: sales growth is notably driven by the Group successful business in Japan (+9.6%). The manufacturing project in India, developed in partnership with the CK Birla Group, is on track.

Eurasia: stable sales. Sales increase notably in Ukraine (+7%). The good dynamic of Peugeot 3008, C4 Sedan and the newly produced LCVs in Kaluga since April (Peugeot Expert and Citroën Jumpy) are encouraging.

“In an increasingly unstable environment, we thrived with the rigorous execution of our efficient core model strategy. The product appeal to our B2B or B2C customers supports our pricing power policy for all of our brands, while we are currently implementing our electrified offensive. Agility and Darwinian spirit are more than ever important to tackle forthcoming challenges and enhance our customer satisfaction” comments Carlos Tavares, Chairman of the Managing Board of Groupe PSA

In 2018, Peugeot is the market leader in France and is still growing by half a point of market share

With more than 468,000 vehicles sold in France in 2018 in terms of PV + LCV, PEUGEOT achieved an excellent performance with more than 28,000 additional vehicles compared to 2017. The lion brand progressed by half a point of market share for the second year in a row. PEUGEOT:

- Is the market leader

- Is the B2B market leader in the VP market

- Shows a gain in market share in VP and VP + VU of 0.5 point

- Progress twice as much as the market

This performance continues to be driven by the success of the SUV range with the PEUGEOT 2008, 3008 and 5008 which have a market share of 8.4%, a gain of 0.8 points compared to the same period of 2017. ‘one SUV out of four sold in France is PEUGEOT brand.

Cumulative 2018:

- Two PEUGEOT vehicles are on the podium of the most popular passenger cars in France:

- The PEUGEOT 208 occupies 2nd place with a market share of 4.7%.

- The Peugeot 3008 is the 3 rd place with a market share of 3.9%.

- Two PEUGEOT vehicles are leaders in their segment:

- The PEUGEOT 308 in the compact sedan segment with a market share of 2.9%.

- The PEUGEOT 3008 on the C-SUV segment with a market share of 3.9%.

- In a VP market up 3%, PEUGEOT rose by 6.2%. The brand has a market share of 17.9%, up 0.5 point.

- In a UP market up 4.7%, PEUGEOT is up 6.7%. The brand posted a market share of 17.1%, up 0.3 points and thus consolidates its second place of builders it has held for three years now.

- In a VP + VU market up 3.3%, PEUGEOT posted volumes up 6.3% and reached a market share of 17.8%, up 0.5 point.

Summary of PEUGEOT 2018 commercial results

- 1,740,283 PEUGEOT vehicles sold worldwide.

- Worldwide sales of the brand excluding JV increased by 2.4%.

- Best sales growth of the top ten manufacturers in Europe.

- 16 countries break their record in market share and/or deliveries:

- Record market share: France and Italy

- Record market share and deliveries: Portugal, Greece and Ireland

- Record deliveries: Spain, Poland, Chile, Czech Republic, Morocco, Japan, Mexico, Slovakia, Hong Kong, Croatia and Estonia

- New LCV record with 243,000 vehicles sold worldwide, up 4% from the record already set in 2017:

- PEUGEOT Boxer sales record: 73,000 vehicles (+6%)

- PEUGEOT Expert /Traveller sales record: 78,000 vehicles (+31%)

- New PEUGEOT Partner elected International Van Of The Year (IVOTY)

- Historic record for PEUGEOT France

- Leader in private sales

- Leader in sales on the B2B channel to passangers cars

- Successful launches of new vehicles:

- New PEUGEOT 508: more than 10,000 orders

- New PEUGEOT Rifter: more than 20,000 orders

- New PEUGEOT Partner: more than 11,000 orders

- Success of the move up market brand’s strategy:

- Mix GT Line/GT/GTi level at 21% worldwide (+ 2 points)

- Mix automatic gearboxes of 36% (+ 6 points)

- Peaceful energy transition for PEUGEOT without interrupting offers when the new standards of September 1, 2018 are adopted.

IN 2018, CITROËN PROGRESSE FASTER THAN THE MARKET IN VP AS IN VUL

For the full year of 2018, Citroën has more than 286,300 registered LCVs + LCVs in France, representing a growth of 5.9%, significantly higher than that of the market (+ 3.3%). Result : the Brand gains ground and reaches 10.9% of market share, 0.3 point conquered compared to 2017.

In passenger cars, Citroën posted the strongest growth of French brands in December : + 13.7%. Over the year as a whole, the Brand’s growth is more than twice that of the market : + 6.2% in a + 3% market. The Brand gains 0.3 points of market share compared to 2017. A performance driven by the success of its product offensive, including:

- C3 , the Brand’s bestseller, which is posting annual growth of nearly 16% over 2017

- New C3 Aircross SUV , 2 nd best annual sales Citroën and 2 nd best sellers in its segment (B-SUV) to individuals in December

- New C4 Cactus sedan, launched in March, allowing the model to show an annual growth of over 18% compared to 2017 (with C4 Cactus 1 st generation)

- New Berlingo, launched in September and making Berlingo the leader of MPVs in 2018

- C1 , which has annual growth of more than 20% and ranks as the second-best-selling second- ranked city car in December

As for LCVs (light commercial vehicles), the success of the Citroën utility range was also confirmed in 2018 with annual growth of the Marque superior to that of the market: + 5.1% in a +4.7 market %. Thus, Citroën gains 0.1 points of market share compared to 2017, reaching 15.8%.

STRONG SUCCESSFUL PRODUCT OFFENSIVE, CITROËN REALIZES A RECORD OF SALES IN EUROPE FOR 7 YEARS

” Building on our renewed and coherent range, with no less than 6 major launches since 2016, we have achieved in 2018 a sales record in Europe over the past 7 years, with market share gains in both VLV and LCV. This beautiful performance highlights the attraction of the ‘New Citroën’ that we have built for 4 years. And this dynamic will continue this year with the launch of the new C5 Aircross SUV and the continued launch of the New Berlingo marketed since last September. 2019 is also the year of the centenary of Citroën, with many surprises in the key ! I’ll meet you in March at the Geneva Motor Show to learn more ! ”

Linda Jackson , Managing Director of Citroën

EUROPE (30 COUNTRIES): 825,000 sales

- Record sales volume for 7 years (800,000 sales had not been made since 2011)

- 5 th consecutive year of growth => + 28% vs. 2013

- In registrations : the Brand is gaining ground on all fronts:

- VP + VUL : growth of 4.6% , very much higher than the market (+ 0.3%) => + 0.2 pt of PdM * (4.5%)

- VP : growth of 5.0% in a stable market (-0.0%) => +0.2 pt of PdM (3.8%). It is the fastest growth of the Top 12 brands in Europe (ex aequo with Peugeot)

- LCV : growth of 3.5% , higher than the market (+ 3.0%) => 9.5% of PdM /Citroën in the Top 5 most popular brands in Europe (gain of 1 place)

A DYNAMIC WIDED BY THE SUCCESS OF THE LATEST LAUNCHES

- C3 : more than 510,000 sales since its launch (Nov 2016) including more than 240,000 in 2018

- In Europe = 6% growth in orders vs. 2017

- Rich mixes : 40% ‘Shine’ (level 3/3) / 65% two tone / 55% ‘Airbump’ / 25% optional interiors

- SUV C3 Aircross : nearly 160,000 sales since its launch (Oct. 2017) including more than 120,000 in 2018

- 2 nd best global sales of Citroen (after C3)

- Rich mixes: 50% ‘Shine’ (level 3/3) / 30% optional interiors / 30% bi-tone / 25% Color Packs

- C4 Cactus : pr è s 80 000 sales in 2018

- 33% growth vs. 2017 thanks to the new model (vs. C4 Cactus 1 st generation)

- Rich mixes : 55% ‘Shine’ (level 3/3) / 55% Color Packs / 65% ‘Advanced Comfort’ seats

- Jumpy / SpaceTourer : pr è s 140 000 sales since inception (2016) more than 60 000 2018 or + 19% vs. 2017

- New Berlingo Van / Berlingo : launched since September and already 42,000 sales.

- Berlingo VU = leader of its segment (F1) in Europe (based on registrations 11 months 2018)

- Aircross SUV C5 (excluding China) just launched in Europe, it already accounts for more than 6 000 sales

CHINA & SOUTH EAST ASIA: 114,000 sales

- If China confirmed its position 2 nd World Market Citroen , the decline of the Chinese market (-2% on the year, including 10% in H2 *) marked by increased competition (price war fueled by more than 100 brands ), led to a decline in the Brand’s sales in the country (-13%).

- In 2018, the brand continued to deploy its SUV offensive with the launch of C4 Aircross(Chinese version of C3 Aircross) in late September (nearly 2,000 sales). For its part, theCCD Aircross SUV, launched in September 2017, has totaled nearly 50,000 sales since its launch (nearly 25,000 in 2018).

- In 2019, Citroën will continue its offensive with, on January 16, the reveal of the mid-life of the SUV C3-XR which will be marketed in March.

LATIN AMERICA : 60,400 sales

- In this area, the decline in sales is largely related to the collapse of the Argentine market (-10% / – 32% in H2), 1 st market area for Citroën, and the depreciation of the exchange rate.

- However, sales of Citroën rose in Brazil (2 nd market) and Chile (3 rd market), but also inEcuador and Colombia (respectively + 1.5%, + 10%, + 71%, + 43% )

- The local version of C4 Cactus (produced in Porto Real in Br) was launched in September => excellent welcome that leads to nearly 9,000 local sales of C4 Cactus a volume multiplied by 4.5 vs 2017!

- Also noteworthy: sales growth of New C3 (+ 9.5%) and New Jumpy (locally produced in Uruguay since H2 2017), sales of which more than doubled.

MIDDLE EAST & AFRICA : 34,700 sales

- The decline in sales in this region is largely due to the fall of the Turkish market (-35% over the year, including 52% in H2) which is the 1 st market area for Citroën (Turkey alone accounted for 46% of Citroën sales in the region in 2017, and represents only 23% in 2018).

- Nevertheless, in the overseas departments (related to this region), Citroën’s sales increased , particularly in Réunion (+ 13%), Guadeloupe (+ 17%) and Guyana (+ 2.5%)

EURASIE : 6,400 sales

- With the launch of Jumpy / SpaceTourer produced in Kaluga (local bestseller) in the S1 ,the Brand stabilized its sales (+ 0.7%) against the backdrop of the slowdown in the Russian market in H2.

- In Ukraine , the Brand’s registrations grow by almost 50% in a declining market, which allows it to gain almost one point of market share (which reaches 2.8%)

INDIA & PACIFIC : 5,700 sales

- After an exceptional 2017 (+ 36% vs 2016), 2018 confirms a good volume performance in this region : -390 sales vs 2017, but still + 27% vs 2016

- Note: Japan (1 st market) = 7% of sales, a record for 20 years / South Korea (2 ndmarket) = 27% / C3 = local bestseller, up 66 %.

* ‘ PdM’ = abbreviation of ‘market share’ / ‘S ‘ = abbreviation of ‘semester’ => ex : ‘S2’ = ‘ 2ndsemester’.

Consolidated world sales by regions

[1] Peugeot 4008 in China[2] C4 Aircross in China

[3] PHEV: Plug-in Hybrid Electric Vehicle

[4] EV : Electric Vehicle

[5] PCDOV figures

[6] Iran: Volumes industrialized in Iran are not more recorded in consolidated sales since May 1st 2018

[7] PCD: Peugeot Citroën DS